Introduction

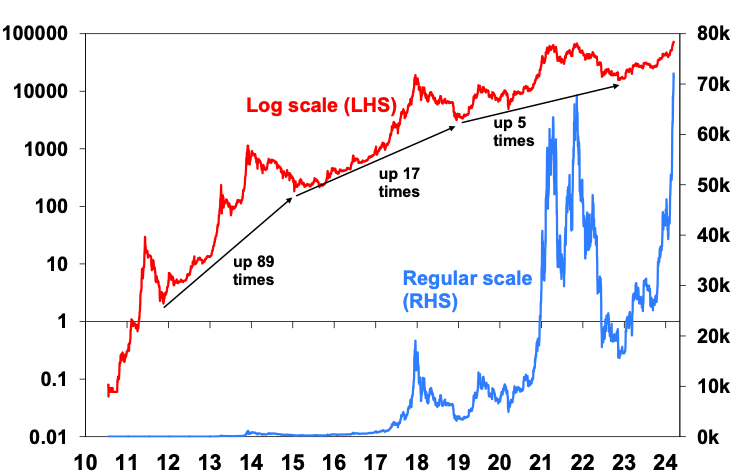

After another 80% or so plunge from its high in 2021 to its low in 2022, Bitcoin has rebounded again to a new record high. The next chart shows Bitcoin’s price relative to the $US since 2010, both on a regular scale and on a log scale to show perspective. From its 2022 low it’s up more than fourfold. This is naturally sparking a new round of questions as to “what’s driving it”? and “should we invest in it”? The answer not simple. Bitcoin attracts extreme views – evangelists on the one hand and agnostics and atheists on the other in contrast to other things where the debate is between bulls and bears. This note looks at what it means for investors.

Bitcoin price in US dollars

Source: Bloomberg, AMP

Bitcoin basics

Bitcoin was invented in 2008 by a person or group named Satoshi Nakamoto and the first “genesis block” was created in 2009. Trying to explain it and cryptocurrencies generally (and the blockchain technology that underpins them) is very complicated! The blockchain basically means that transactions in Bitcoin are verified and recorded in a public ledger (the blockchain) by a network of nodes (or databases) on the internet. New Bitcoins are created as a reward for an intensive computational record keeping process called mining, that groups new transactions into a block which is added to the chain. This requires significant computing power to show what is called “proof of work”. The supply of Bitcoins is limited to 21 million, but because of a process called “halving” which occurs roughly every four years and sees miners compensated by less Bitcoins over time the limit will only be reached around 2140 after which transactions fees will be the only reward for record keeping. Because each node stores its own copy, there is no need for a trusted central authority like a central bank. Bitcoin is also anonymous with funds tied to Bitcoin addresses which require a private key (a long password) to access.

Because of Bitcoin’s limited supply and independence from government it’s seen as a hedge against the debasement of paper currencies (through inflation), the failure of central banks or outright seizure. This has made it attractive to supporters of the Austrian school of economics (which advocates a free market in money), libertarians and anarchists.

As with most technologies, the more that use it the greater its appeal. So news that various groups will accept transactions in it, El Salvador’s 2021 move to allow it as legal tender and various financial organisations allowing customer access via their platforms have aided its growth. The recent approval of Bitcoin ETFs and regulation of it, along with a coming halving (around April) have helped propel the recent surge in its price.

The number of cryptocurrencies blew out to more than 10,000 at the end 2023. Some started as jokes (eg, Dogecoin); some prioritise underpinning smart contracts (like Ethereum); some prioritise transactions (stablecoins that link to the value of a paper currency, eg, Tether); whereas others prioritise being a store of value independent of government (eg, Bitcoin). Of course, there is a lot of overlap. The focus for most remains on Bitcoin which is the oldest and biggest with a near 50% crypto market share.

Reasons for scepticism

Bitcoin enthusiasts see it as the future currency and as a way to riches with rapid price gains since inception seen as confirmation. The counter view is that it’s just another bubble. Reasons for caution are as follows:

-

First, it’s not suitable for everyday transactions: Bitcoin transactions are not cheap costing $US9 at present; they can take 8 minutes or so to complete; its price is very volatile (being roughly 13 times greater than US shares, 12 times greater than gold, 26 times greater than the $US and 17 times greater than the $A/$US exchange rate) suffering 80% plunges in price every few years (in 2011, 2013-15, 2017-18 and 2021-22) rendering it unreliable as a short term store of value. Its limited value for use as a means of payment explains why most Bitcoin transactions are by speculators, not merchants. This is not to say Bitcoin may not have a role in some countries – eg, El Salvador – where the government is not trusted and much of the population lives in the US and faces high transaction costs sending money home. But even in El Salvador merchants have not rushed into using Bitcoin and the US, Europe & Australia are not banana republics!

-

Second, there may be a role for cryptocurrency in payments systems (either stablecoins or Ethereum that have moved to speed up their processing), but who knows which one it will be and governments are likely to want to provide it themselves. But even here work on Central Bank Digital Currencies has slowed as its not clear people want to use them as we can already do digital transactions instantly & cheaply. There is almost certainly a role for blockchain technology in smart contracts but it’s hard to work out which cryptocurrencies it will be.

-

Third, given the uncertainty around the use case for cryptocurrencies and particularly Bitcoin (which is less amenable for smart contracts and payments), it’s very hard if not impossible to value. Unlike property or shares, it is not a capital asset and so does not generate rents or earnings. Unlike most commodities, it is not used to make things. Most of the major positive news about its value (eg the introduction of Bitcoin ETFs) have nothing to do with its fundamental use or value. Some claim it can generate a “yield” if you lend (or stake) your Bitcoin to traders…but this is relying on them actually making money trading crypto currencies. This makes it impossible to put a price on what it’s worth – it could go to $1,000,000 or $100.

-

Fourth, cryptocurrencies have had various issues with illegal activity and a lack of integrity. While there have been no cases of the Bitcoin or Ethereum blockchains being hacked, there have been high profile cases of people having their private keys hacked, people losing their holding via crypto exchanges and people simply losing their keys. Cryptocurrencies, notably Bitcoin, are also used for criminal activity. One benefit of using a bank to hold your cash is that it provides protection in the event your account is compromised, or you lose your password. Of course, wild west behaviour can be common at the start of new asset classes which may settle with regulation.

-

Fifth, the computing power involved in mining for Bitcoin requires significant electricity, just below that of Denmark. This makes it bad for the environment. A single Bitcoin transaction consumes as much energy as 500,000 Visa transactions. Of course, not all cryptos are the same with those using a “proof of stake” (or proof of ownership of a currency) being less energy intensive (but arguably also less secure).

-

Finally, Bitcoin and other crypto currencies face numerous threats from governments. Many governments have been looking at doing CBDCs although progress has been slow. Government’s may also crack down on illicit use of crypto currencies, its energy use and regulation is on the rise – although some see this as strengthening it.

Is Bitcoin “digital gold’?

Bitcoins longevity, its ability to rebound to new highs after each setback (so far), the potential use value from blockchain technology in smart contracts and decentralised finance and progress to greater respectability (with regulation on the rise) suggests Bitcoin and cryptocurrencies can’t simply be dismissed as just another bubble.

However, the question remains that if Bitcoin is not really digital cash and it’s not a capital asset suitable for normal valuation, what is it? The short answer is that it’s something to speculate on. The strongest argument for its existence is that it’s a digital version of gold and is displacing some of the demand that would have gone into gold. For millennia there has been demand for precious metals, like gold. While gold has a fall-back use as jewellery, its use for this does not explain movements in its price. Rather it has value because enough people have faith in it as a store of wealth which is independent of government – and people buy it not because they see jewellery demand going up but if they believe someone will pay a higher price for it. Some call this the “greater fool” theory.

Apart from not having the fall back of jewellery demand and not being able to see and touch, Bitcoin has many of the characteristics of gold – notably limited supply and independence of government. Bitcoin’s resistance to relaxing its proof of work approach has by limiting its ability to be used as cash effectively strengthened its decentralisation and immutability characteristics – making it more gold like (unlike many other cryptos). Like gold bugs it has a similar demand base of people who don’t trust central banks and governments. Which partly explains why Bitcoin resembles “more of a cult than a currency” – with a god (the mysterious Satoshi Nakamoto), a belief set and defined behaviours. Critical amongst the latter is to hodl (buy and “hold on for dear life”) and have faith that new buyers will come along to keep it going to the moon, Of course many might describe this as a giant Ponzi scheme (without the illegality).

Of course, Bitcoin has arguably failed its first big test as a hedge against inflation because as inflation surged in 2022 Bitcoin saw a near 80% fall in value. Gold has also failed as an inflation hedge at various points though, but this has not stopped faith in it. Bitcoin’s rising sensitivity to movements in interest rates suggest its becoming more gold like as rising rates increase the opportunity cost of holding gold or Bitcoin and vice versa for falling rates – like now which has pushed both to record highs.

If Bitcoin is digital gold it could have lots more upside as younger digital savvy buyers favour it over gold. Rough estimates suggest that if Bitcoin were to approach say 25% of the market value of gold its price could rise to $US160,000. Increasing ease of exposure via vehicles like ETF’s could see it pushed beyond that as buyers extrapolate past gains. But just be aware that owes to an assumption that enough have faith. If investors decide to move on to a new next best thing then watch out below!

So what does all this mean for investors?

There are five key things to be aware of when considering an investment in Bitcoin or crypto currencies. First, Bitcoin may have a lot more upside: its very momentum driven so its recent gains will attract new buyers; new demand via ETFs and the next “halving” are giving it a push; it tends to run to a four-year cycle which would run into next year; and displacement of gold may have further to go. So far we are yet to see all the crypto ads like in late 2021/early 2022 which suggests its yet to hit a manic phase. It is worth cautioning though that as more own crypos their returns appear to be slowing (as highlighted by the arrows in first chart).

Second, none of this has anything to do with a fundamental assessment as to Bitcoin’s worth which is impossible. Like gold it depends on faith that more buyers will arrive to push its price ever higher.

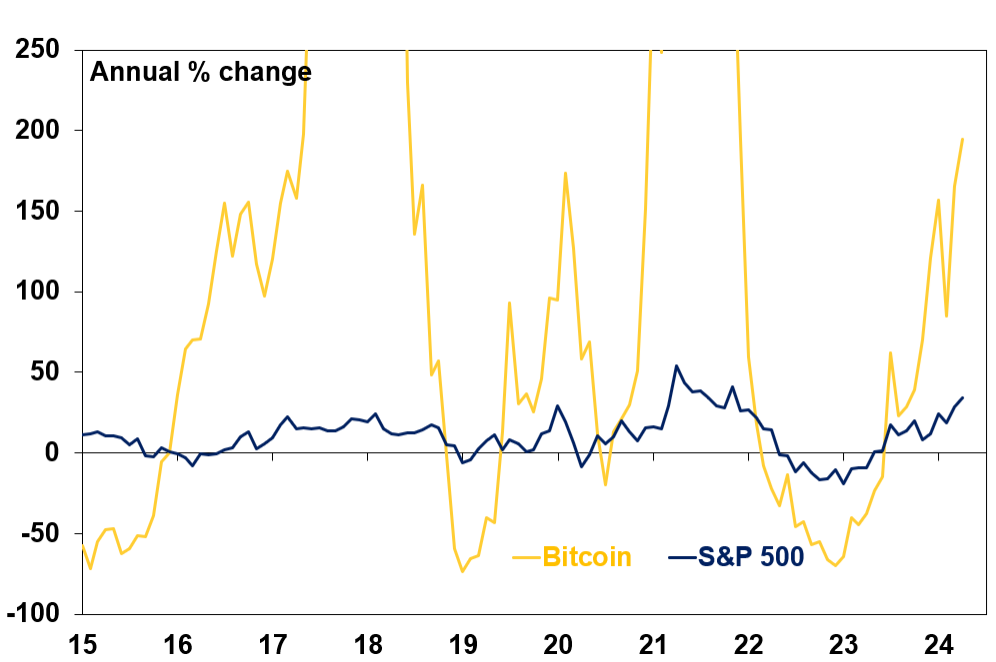

Third, it’s hard to work out where to put Bitcoin in a portfolio. It’s too volatile to be a defensive asset like cash. It’s impossible to get any reasonable idea as to what it may be worth or return (unlike shares, property, bonds or regular cash). And since its inception its seen a rising positive correlation with shares (averaging 40% over the last five years) with a beta of 2.3 times shares – so if US shares move 1% it moves by more than twice as much in the same direction – so its a poor diversifier.

Bitcoin vs US Shares

Source: Bloomberg, AMP

Fourth, its extreme volatility means investors should expect a wild ride.

Finally, don’t forget the basic principles of investing – there is no free lunch (high returns mean high risk); past returns are a poor guide to future returns; and if you don’t understand something, don’t invest in it.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital March 2024

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.